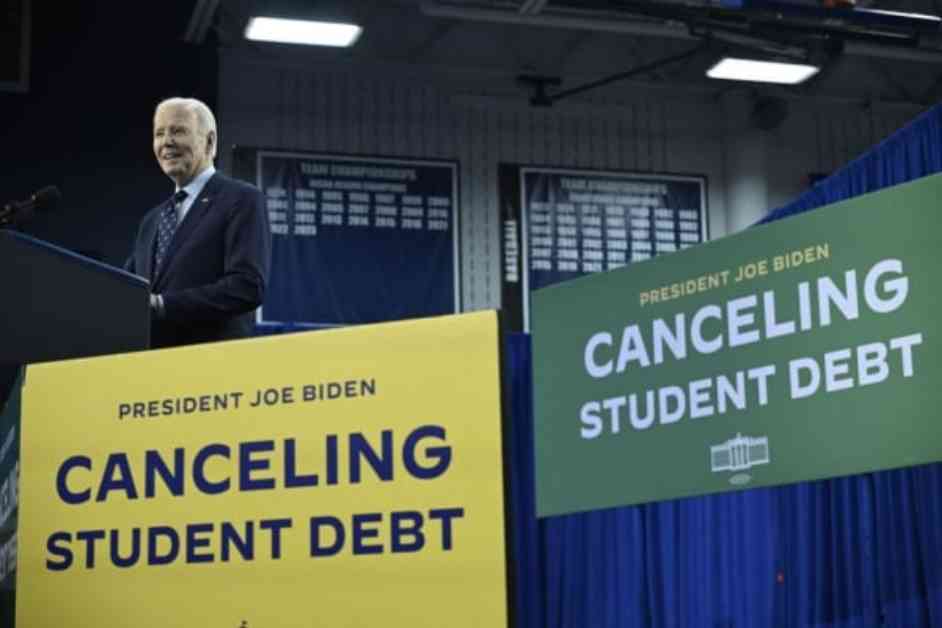

State GOPs File Lawsuit to Block President Biden’s Student Loan Forgiveness Plan

President Biden’s ambitious plan to provide debt relief for nearly 28 million Americans is facing a legal challenge from several Republican-led states, even before it has been finalized. The lawsuit, filed by Missouri Attorney General Andrew Bailey and six other states, seeks to halt the plan, arguing that the Education Department is exceeding its legal authority by attempting to mass cancel billions of dollars in student loans without proper judicial review.

The lawsuit alleges that the Biden administration is planning to start discharging billions in student loans as early as this week as part of a comprehensive debt relief program. The states are concerned that the plan, if implemented, would have significant financial implications for both the states and state-created entities managing federal student loans.

Legal Battle Over Student Loan Forgiveness

This legal battle marks the third time that Republican-led states have challenged President Biden’s efforts to forgive student loans. In the past, these states have been successful in blocking previous loan forgiveness plans proposed by the administration. The Supreme Court previously struck down a plan to forgive up to $20,000 in student loans for eligible Americans, affecting approximately 43 million borrowers.

In a statement, Attorney General Andrew Bailey expressed confidence in their ability to block the current forgiveness plan, stating, “We successfully halted their first two illegal student loan cancellation schemes; I have no doubt we will secure yet another win to block the third one.”

The lawsuit argues that the Biden administration’s plan to forgive student loans is an unlawful overreach of executive authority, and the states are seeking a court order to prevent the Education Department from moving forward with its debt relief plans. The states claim that the plan, if implemented, would bypass judicial review and could potentially influence the outcome of the upcoming election.

Details of the Debt Relief Plan

Despite facing legal challenges, the Education Department is continuing to work on finalizing the regulations for the debt relief plan. The plan aims to provide loan forgiveness for groups of borrowers who have been struggling with their student loan repayments, including those who have been repaying their loans for more than 20 years and those whose college programs did not provide sufficient financial value.

The costliest part of the plan involves forgiving interest on student loans, benefiting an estimated 26 million borrowers. The department has projected that this aspect of the plan would cost $62 billion over the next 10 years. However, the states challenging the plan claim that the total cost would be closer to $73 billion, although they did not provide a source for this figure. Overall, the total cost of the debt relief plan is estimated to be $147 billion over a decade.

Concerns Over Rushed Implementation

Critics of the debt relief plan have raised concerns about the rushed implementation timeline outlined by the Education Department. Documents obtained by the states show that officials have been coordinating with federal loan servicers to prepare for the discharge of loans, indicating that the department is moving forward with its plans despite the legal challenges.

The states argue that the department’s decision to ask borrowers to confirm whether they want to opt out of the relief program before it is finalized is concerning. This preemptive action has raised fears that the department may rush to implement the plan before it can be legally challenged, creating confusion and chaos for borrowers.

Representative Virginia Foxx, who chairs the House education committee, criticized the department for its approach to the debt relief program, calling it “the apex of arrogance” to auto-enroll borrowers in a program that does not yet exist. Foxx expressed concerns that the department may publish a regulation with immediate effect, wiping out billions of dollars in loans overnight, only to have a court halt the rule later.

Future of Student Loan Forgiveness

As the legal battle over student loan forgiveness continues, borrowers and policymakers alike are closely watching the developments surrounding President Biden’s debt relief plan. The outcome of the lawsuit filed by the Republican-led states could have far-reaching implications for millions of Americans struggling with student loan debt.

While the Biden administration remains committed to providing relief for borrowers, the legal challenges pose a significant obstacle to the implementation of the debt forgiveness plan. As the Education Department works to finalize the regulations for the program, the timeline for providing relief to borrowers remains uncertain.

Conclusion

The lawsuit filed by Republican-led states to block President Biden’s student loan forgiveness plan highlights the ongoing debate over the role of executive authority in providing relief to borrowers. As legal challenges continue to unfold, the future of the debt relief program remains uncertain. Borrowers and policymakers alike will be closely monitoring the developments surrounding this contentious issue.