A recent report released by the College Futures Foundation in California indicates that the majority of college programs in the state allow graduates to recover the costs of their education within five years. However, some programs leave recent graduates earning less than those with only a high school diploma, particularly at private, for-profit colleges. These programs are flagged as having no economic return on investment.

In contrast, all programs analyzed at the California State University and the University of California had a positive return on investment. Less than 1% of programs at both university systems were expected to take more than 10 years to pay off. Eloy Ortiz Oakley, the president and CEO of the College Futures Foundation, emphasized the importance of transparency and information for students and families investing in higher education.

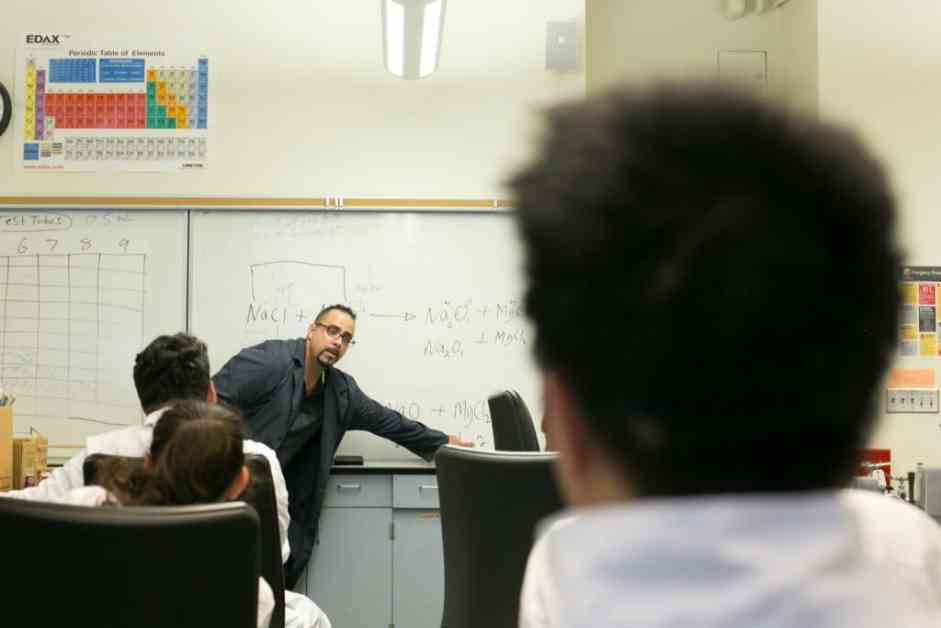

The report, titled “California College Programs That Pay,” examines data from the U.S. Department of Education’s College Scorecard to understand the earnings of graduates from undergraduate certificate, associate, and bachelor’s degree programs in California. Itzkowitz compared students’ out-of-pocket costs for a credential to the additional money they earn after completing it.

The study found that 88% of programs allowed graduates to recoup the costs of their credential within five years. Median earnings five years after graduation were substantially higher than those of a typical high school graduate for the majority of programs. However, 12% of programs took five years or longer to recover costs, with 112 programs showing no economic return on investment.

For-profit institutions had a higher percentage of programs with no return on investment compared to nonprofit and public institutions. Fields like cosmetology and somatic bodywork stood out as having the most programs with no economic payoff. The report also highlighted differences in return on investment across education sectors.

Oakley expressed the hope that the report would prompt further research into programs attracting students of color, regional distribution of high-return programs, and strategies to replicate programs with the best economic payoff. He emphasized the need for institutions to understand why certain programs provide a good return on investment.

While the report primarily focuses on earnings in the first five years after graduation, other research has examined projected earnings over a longer time frame. For instance, a report from Georgetown University’s Center on Education and the Workforce ranked colleges based on projected returns 40 years after enrollment. Another study from the Foundation for Research on Equal Opportunity framed return on investment in terms of lifetime earnings after subtracting college costs and considering completion rates.

In conclusion, the report sheds light on the economic value of different college programs and the importance of transparency for students and families making investments in higher education. It underscores the need for further research to identify programs with the best economic outcomes and to understand the factors influencing return on investment in higher education.